Personal loans are also a type of loan provided by a bank or NBFC (Non-Banking Financial Company) which we also call Private Finance. These loans are usually General Purpose Loans, which you can take to complete an Instant Financial Requirement because you need to have at least Documents as compared to any other loan and to do this Minimum Formalities It does.

Therefore, if you are Eligible for such loan, then after the Loan Approve it becomes processed very fast. That is, if you are Eligible and complete all the Documentations, then within a week your Personal Loan becomes credited to your Bank A / c.

Personal loan is a loan that the bank does not track. That is, do not take care of what kind of loan amount you are spending to meet the need. For example, if you take home loan, the bank wants you to spend that loan amount for your home. In the same way, if you take a Car Loan, Bank wants you to spend that loan on purchasing a car. But when you take a Personal Loan, then the bank does not have any sense about where and how you spend that loan amount.

Generally, Personal Loan is taken only to Fulfill an Instant Requirement. But this is not necessarily the case. You can use your Personal Loan to renovate your home, to manage the expenses related to someone's marriage in your family, you can use for any Family Vacation, your child's education Or use for an expensive Electronic Gadget or Home Appliance, or can also be used for any Medical Expense or Emergencies.

You can use your Personal Loans in your business or to repair your car or to make a down payment to buy a new home. How will you use Personal Loan, it is not necessary to tell the Bank or the Lender Financial Institution when you take the loan. Let's understand Personal Loan a bit more well.

Personal Loans are Unsecured

Personal loan is one kind of unsecured loan. That is, you do not need any kind of guarantees to take this kind of loan, nor do you have to pay some mortgage to the bank. Therefore, if you default with the Personal Loan, then there is no such thing as the bank that you can recover from this loan by selling it.

But for this reason, Rules and Regulations of all financial institutions are quite strict for giving such a personal loan, as well as the interest rate levied on Personal Loan so that even if you have some EMIs at the beginning of your personal loan Pay, then most of the bank's loans will reach them in the shortest possible time and they are the only risks of interest.

Even if you default to Personal Loan, even if the Lender Financial Institution can take legal action against you, as well as due to default, your CIBIL score is also poor, due to which you will not get any other item in future There is a lot of difficulty in getting loan of another type, even if you have not done it by mistake, or why you have not defaulted only one rupee.

That's why it is better that you take any loan as a fair consideration and repay it completely so that if you need a loan again in the future, your loan can be easily approve. Also, the biggest benefit of successful repayment of loan is that once you successfully repay a loan, then you do not have to work hard at taking the next loan, but you will have to pay a lot Call from front to NBFCs

Because your CIBIL Credit Score is quite good in the case of successful repayment of loan, and financial institutions feel less risk to pay you loan than giving loan to a new person because you had repay your last loan successfully. . Also, the next time you take the loan, you can also do bargaining to lower the interest rate and often the second time you take the loan, the lower interest rate is offered as you are because you are a valuable loan payer. .

Personal Loans have a Fixed Limit

Normally, there is a Range of Personal Loan that can be provided to any person by any bank or NBFC and not more or less Personal Loan Allowance from that Range. It determines the Range Bank / NBFC itself and is determined by the bank on how much personal loan can be appropriated on the basis of the loan taker's income, credit rating, other loans already taken.

If your Monthly Income is more, more Secure and Sure, you have not already taken any other loan or have successfully repayed your previous loan, if your credit rating is good, You can get loan of up to the highest limit of Personal Loan at the lowest Possible Interest Rate. But when the situation is opposite, you may have to pay the highest interest rate for Minimum Allowable Loan Amount.

Personal Loans usually have Fixed Interest Rates

When borrowing from any financial institution, that financial institution, that bank or NBFC can basically charge you in two ways, called Flat Rate and Reducing Rate of Interest (RRI) or Annual Percent Rate (APR).

In both of these ways the interest is reduced in Reducing Balance Rate. That is, if you are lending a bank 12% Reducing Balance Rate and an NBFC 12% Flat Interest Rate, then you should take a loan from the bank and not the NBFC because your Loan Amount will be reduced with every EMI to be filled in the bank. And you only have to pay interest on the same amount that is owed. While under the Flat Interest Rate, the interest you have to pay in the first EMI, the same interest you have to pay in your last EMI.

The longer the loan repaying period, the more expensive the APR and the more expensive the flat rate. So, as far as possible, you should take loan from the Financial Institution, which is lending itself at the APR Interest Rate. Even though APR for you is twice as fast as Flat Rate. By converting the APR and APR to Flat Rate, you can easily find out which loans will be cheaper for you.

However, whenever you apply for Personal Loan, most financial institutions give you the same loan at Flat Rate because Personal Loan is an Unsecured Loan, therefore the Financial Institution will charge you Higher Interest Rate and Flat Rate compared to APR. Much more happens.

Apart from this, Financial Institutions calculate interest in two more ways, which are commonly known as Fixed Rate and Variable Rate. During the full EMI you have to pay interest as you have taken loan at fixed rate, as decided on loan approval. However, every 3, 6 or 12 months on the loan taken at Variable Rate, according to the RBI policy, the interest rate may be more or less and accordingly, the repayment period of your loan i.e. the number of EMIs or Amount Change of EMI Could.

These two types of interest rates have their own advantages and disadvantages but most other financial institutions provide personal loans at fixed rates only.

Personal Loans - Fixed Number of EMIs

Like any other loan, a fixed time frame is also set to repay the Personal Loan, depending on which number of total EMIs is determined. Normally most banks or NBFCs set a maximum of 3 to 5 years to repay the Personal Loan, where you have to pay a certain amount every month as a monthly EMI (Equal Monthly Installments) for a certain period.

The more you set the Amount Amount, the less your repayment duration and the more you want to repay the loan, the less the amount of your EMI decreases. But for long repayment of loan, you have to pay more interest. So if you are taking a Personal Loan at Flat Rate, then try to repay your loan at least EMIs.

Here also one thing to keep in mind that if you have set up EMI for repaying Personal Loan in 12 installments, then do not repayment in 6 installments by pre-payment, because the bank has made a payment of 12 months of interest on your entire loan only by paying the EMI Set In such a way, by paying 6 installments, you put yourself financially in tight money and give the bank a chance to earn more than 6 months of interest because you have repayed EMI in a 6 month advance, Ti would give as the Loan and earn Interest on Pre-Paid Amount next 6 months.

Therefore, if you can repay the full payment in 6 months, then take a Personal Loan for 6 months instead of 12 months and prepayment in 6 months.

However, if you have got loan on APR Base, in that case as your Principal Amount is repay, interest Amount decreases in every EMI and Principal Amount increases. So in this situation, if you can also pay your loan in 12 months, even then you should fix EMI for as much time as possible.

Suppose you get a maximum time of 3 years in which you can repay your personal loan, while you can repay your entire Personal Loan without any difficulty in just 12 months. Even then you have set an EMI for 3 years and repay it with every EMI whenever you have more surplus. Because now if you repay the double amounts of your EMI every month, in that case you have to pay interest only in one of your EMIs while the second EMI Amount is completely out of your Loan Balance after the Deduct which is left Balance is done, interest rates are the same. Therefore, with the EMI pay, your EMI pay period decreases, that is, the number of EMIs decreases.

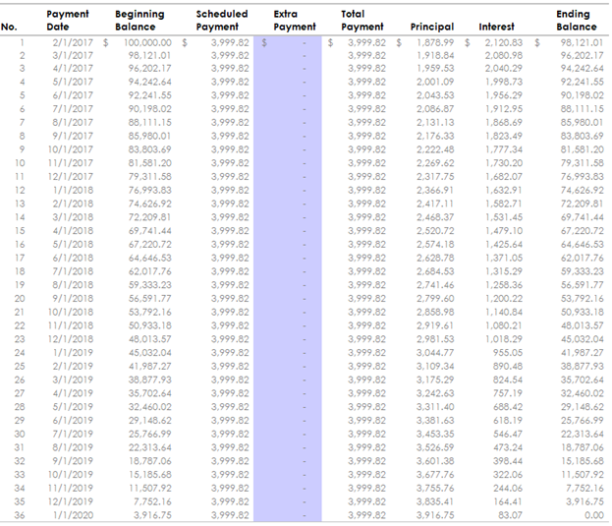

For example, suppose you took a loan of 1 lakh which you have to repay 1.44 lakh in 3 years with interest. That is, you have to pay an EMI of about Rs 4000 per month as per the following illustration -

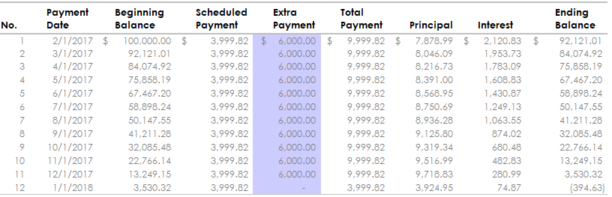

Where in 3 years on this whole loan, you will pay approximately Rs. 4,994 as interest. But if you prepayment Rs 6000 with 4000 EMI every month, you will have to fill up a total of 12 EMI as follows:

And the interest you pay will be only Rs. 13603. However, if your Personal Loan was Interest Rate Flat, in that case you would have to pay a full interest of Rs. 43,994, even if you have made an additional pre-payment of 6000 rupees per month after having set the EMI for 3 years.

There are various types of Charges from Loan Approval to Loan Repayment from different Banks and Financial Institutions, which can be fully understood only after understanding which Financial Institution is more beneficial for you. is.

Therefore, do not choose to borrow a loan from any bank by comparing the Flat or APR Interest Rate, but from the loan Approval to them, in your Bank A / c credit, Processing Fee, Stamp Duty, etc. Find out more about this.

There are also many types of Rules, Regulations and Charges, in the context of pre-payment or pre-closure of different financial institutions, which you need to know in advance so that you can get better Financial Problems for Best Possible Deal Can choose the institute.

For example, if a bank is giving you an APR based Personal Loan but pre-closing, you charge 4% penalty on Total Outstanding Amount or you do not have the facility to prepay before at least 12 EMIs. Or, if you prepay before 12 EMIs, you charge 2% penalty on Total Outstanding Amount, then your loan from such Charges will also cost you much more than loan taken from any other Flat Rate financial institution. Could.

Therefore, if you are Eligible to take out the loan, you should decide only what financial institution you have to borrow since you are not paying any kind of help by giving loan.

Therefore, it is your right to be bargaining about the loan provider financial return, and you also need to get bargaining. Because bargaining will only benefit you in most Situations. Then it does not matter if you are bargaining in a showroom, are bargaining in a hospital, or are bargaining at any bank.

Dear Reader, My name is Manisha Dubey Jha. I have been blogging for 3 years and through the Fast Read.in I have been giving important educational content as far as possible to the reader. Hope you like everyone, please share your classmate too. As a literature person, I am very passionate about reading and participating in my thoughts on paper. So what is better than adopting writing as a profession? With over three years of experience in the given area, I am making an online reputation for my clients. If any mistakes or wrong in the article, please suggest us @ [email protected]

Dear Reader, My name is Manisha Dubey Jha. I have been blogging for 3 years and through the Fast Read.in I have been giving important educational content as far as possible to the reader. Hope you like everyone, please share your classmate too. As a literature person, I am very passionate about reading and participating in my thoughts on paper. So what is better than adopting writing as a profession? With over three years of experience in the given area, I am making an online reputation for my clients. If any mistakes or wrong in the article, please suggest us @ [email protected]

Read More.